Fast, affordable Internet access for all.

Municipal finance is not for the weary.

But for the wise – at least according to the number-crunchers enmeshed in that world – one particular sliver of municipal finance (issuing bonds) has long been a viable way for local communities to finance the construction of municipal broadband networks. And as one Communication Union District in Vermont has discovered, bonding is better – when it’s rated.

Shining a light on bond-backed municipal broadband projects is the recent announcement that ECFiber, Vermont's first Communications Union District (CUD), obtained a BB rating from Standard & Poor Global, the nation’s preeminent credit rating agency. The rating will allow ECFiber to pay lower borrowing costs to complete a network expansion project.

“This is a historic moment,” Stan Williams, ECFiber’s municipal finance advisor said in a prepared statement. “For the first time, a CUD will be issuing a rated bond, which means that many more investors will be competing to buy those bonds, lowering the interest rate. ECFiber has been managed for its entire existence to reach this goal. It’s hard to overstate the importance of this achievement.”

East Central Vermont Telecommunications District governing board chairman F. X. Flinn added that the new bond rating "was made possible by over 16 years of grass-roots persistence, driven by a conviction that working together, our region could overcome the failure of the marketplace to offer decent broadband to all our homes and businesses."

"Along the way, ECFiber had to figure out how to do this with local people and local money, and wound up inventing a new type of municipality, the CUD, which has no taxing power, only the ability to issue tax-exempt revenue bonds backed entirely by customer payments and with no recourse to the underlying assets.”

Financing Vermont’s Expanding Fiber Footprint

As ECFiber officials explain, just about all of the funding to build the CUD’s fiber-to-the-home network has been done with borrowed money ($71.83 million). The initial seed money came from 450 local residents who invested $7 million (all of whom were repaid with interest by 2018). But, after being established as the state’s first CUD in 2015, bonds became the principal financing tool.

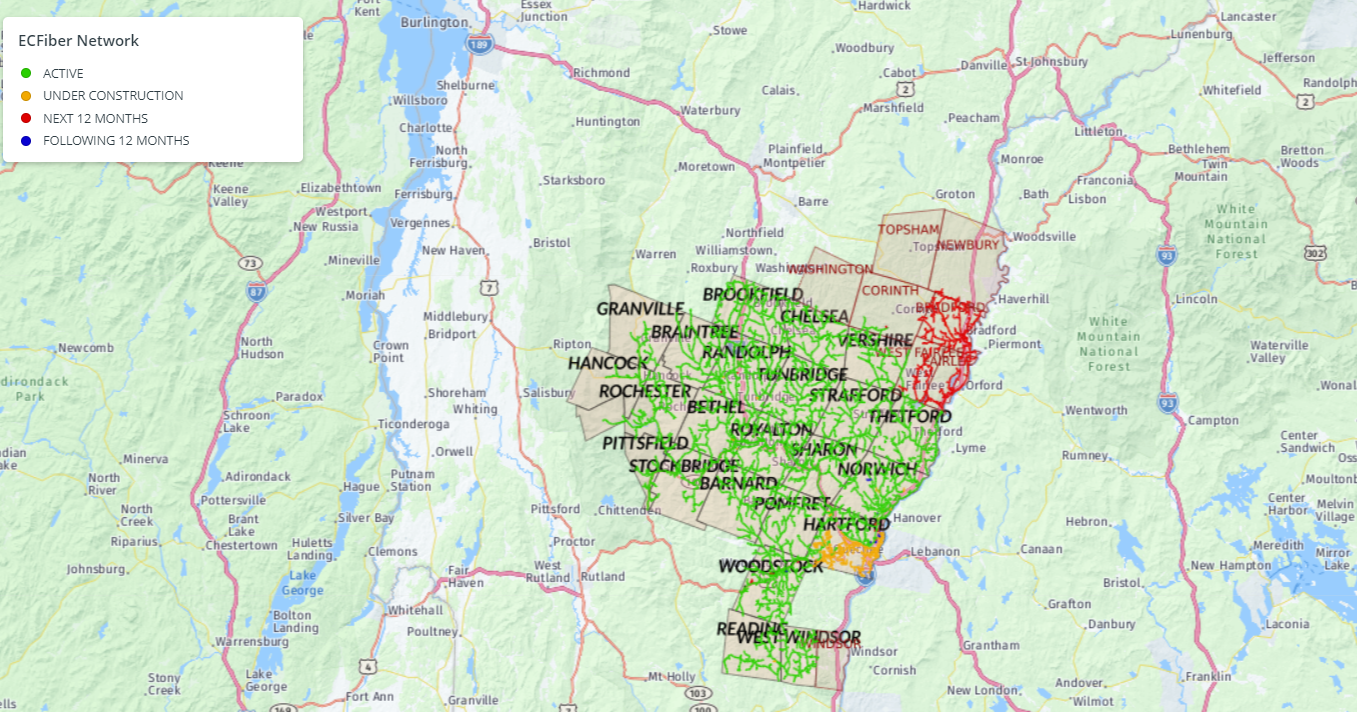

Last summer, ECFiber – which currently serves over 8,000 residential and business subscribers – celebrated the completion of its original mission to build a 23-town fiber network. That milestone was reached when the CUD lit up its White River Junction central hub.

However, in 2020 ECFiber expanded to include eight additional towns as ECFiber’s service area now encompasses 31 towns.

In doing so, ECFiber took a decidedly different approach than privately-owned providers by first targeting the hardest-to-reach parts of its service area.

“Because ECFiber’s buildout process prioritized first bringing broadband to areas that were stuck with dial-up, the denser, cable-served areas were the last part of the network to be built – exactly the opposite approach of cable companies."

“Now that our work in Hartford is focused on customer installations, our construction crews have moved on and are presently building in the Fairlees and Bradford. We plan to complete the entire network by the end of 2025,” said Tom Cecere, who manages ECFiber’s day-to-day business operations.

The rated bond issuance will help pay for expanding the network into the eight towns that have joined ECFiber over the past several years. ECFiber officials say the CUD will issue Series 2023A revenue bonds for $7.53 million, which will help pay for the $30 million network completion plan. With about 25% of the expansion work now complete, an additional $16 million in grant funding from the Vermont Community Broadband Board (VCBB), courtesy of federal Covid relief funds, will be used to pay for the bulk of the new construction, which is expected to be complete by the end of 2025.

For their part, S&P Global assigned the “'BB” rating because for ECFiber “the outlook is stable.”

In a prepared statement S&P Global Ratings credit analyst David Bodek said the rating could change – but only if “debt service coverage, liquidity, or leverage metrics are weaker than projected because the district is unable to secure grant money, realizes weaker than projected customer growth, encounters higher than forecast system expansion costs, or customers cancel service due to the district imposing higher monthly charges or migrate to alternative providers' offerings.”

While the issuance of bonds are not completely risk-free, in Vermont state leaders have prioritized CUDs to be the primary recipients of the federal windfall in grant funds coming to the Green Mountain State. Also, as noted by Internet Society board member and Internet Hall of Fame inductee George Sadowsky, “with a take up rate of about 30%, ECFiber generates a revenue stream considerably surpassing its requirements for interest payments and debt renewal to its bond holders.”

The Value of Rated Bonds

What ECFiber is doing is backed up by analysis. In 2022, the FDIC’s Center for Financial Research (CFR) sought to answer the question “Do Municipalities Pay More to Issue Unrated Bonds?”

The study highlighted something often overlooked by municipalities in financing capital projects. The authors found that approximately 34% of local municipal bond issues were issued without ratings between 1998 to 2017, which collectively “cost municipalities $22.5B in higher interest expense during our sample period.”

Why would municipalities issue non-rated bonds? The study suggests it’s because municipal officials don’t know any better or are misled by underwriters. The paper notes the dynamics involved as “dual underwriters … also work as advisors to the (municipal) issuer.”

It’s an arrangement, the authors said, in which “underwriters benefit from not obtaining a rating because it lowers the price investors are willing to pay from the bond” while simultaneously lowering what an underwriter pays the bond-issuer, which “increases the underwriter’s profit.”

The paper goes on to conclude that “unrated bonds could lower offering yields by 47 basis points for revenue bonds and 49 basis points for general obligation bonds by obtaining a rating .... These potential savings indicate issuers do not fully appreciate the value of obtaining a rating.”

ECFiber officials certainly appreciate the value of obtaining a bond rating. And while BEAD grants will provide substantial capital to build out broadband networks in many rural areas, cities and more densely populated communities will likely not get much, if any, BEAD dollars.

For those communities, word is bond. Or rather, issuing bonds is an increasingly suitable and attractive path for communities interested in building publicly-owned, locally-controlled broadband networks.

Step into our time machine and listen to our Community Broadband Bits podcast Episode 251 where CBN Director Christopher Mitchell talks with ECFiber officials on the ups and downs they faced and how they overcame early challenges in establishing the state's first CUD.

Header image of “Financial Peace of Mind” button courtesy of QuoteInspector.com, Attribution-NoDerivs 4.0 International

Inline image of ECFiber van courtesy of ECFiber

Inline image of bonds stock photo courtesy of The Blue Diamond Gallery, Attribution-ShareAlike 3.0 Unported